What People Ask Us

Start Here: Fees, Process, & Expectations

We work on most cases on a contingency basis. You pay nothing up front. Our fee comes from the money we recover or from a separate amount ordered by a court. or from a judge’s order that the company reimburse your legal costs (called fee-shifting). Fee-shifting when you win is part of federal laws like RESPA and EFTA. It also appears in the Consumer Protection Acts of DC and Maryland.

If we’re defending you in a foreclosure, we may agree on a discounted hourly or flat fee instead. Either way, we lay out every cost in writing before you sign.

I’m licensed in Washington, DC, Maryland, and Illinois, plus some U.S. federal courts.

If your case involves federal statutes like RESPA, EFTA, or TILA, I can handle it even if you live in a different state.

For state-law issues, I can either request temporary admission (pro hac vice) or connect you with a consumer lawyer in your state for free. Not sure where you fit? Reach out and we’ll map the best path.

You’ll walk me through what happened and share any key dates or documents you already have. I’ll ask questions to find possible legal theories. These could be a lawsuit, a foreclosure defense, or something else. This talk is just a first step and relies on the facts you share during the call.

I’ll explain the potential next steps, along with any fees involved and a ball-park timeline. After the call, you will know two things: (1) if your issue is in our area of expertise and (2) what it will cost for us to look into it more.

Many mortgage-servicing or bank-fraud cases in DC and Maryland resolve in 6 – 18 months. If we go to trial, expect another 16–24 months. The timeline depends on the court’s calendar, the other side’s tactics, and whether the case settles early or goes to trial. Your hands-on time comes in short bursts: (1) gather key documents first, (2) answer questions or have a deposition later, and (3) review settlement offers. We handle the day-to-day filings, hearings, and negotiations and keep you updated at each stage.

Feeling anxious is normal. Most people don’t come to a lawyer because they are looking to pick a fight. You’ve asked, called, and complained, and the company still isn’t listening. A lawsuit is our next step. It puts the company under oath, sets deadlines, and holds them accountable in court.

From day one we prepare the case as if a jury will hear it. That trial-ready stance often leads to serious settlement talks. But if a verdict is the only way to achieve justice, we’re ready to select a jury and prove your case in court. You won’t be dragged into every skirmish. We handle the filings, discovery, and hearings. Yet you’ll know exactly where we stand at each stage. Litigation is leverage and a clear path to trial when that’s what it takes to win.

A practice is unfair if it causes serious harm to consumers that can’t be avoided. This harm should not be balanced by any benefits to consumers or competition.

A practice is deceptive if it can mislead a reasonable person about something important, like price, terms, or safety.

These definitions come from the FTC’s Unfairness Policy Statement and FTC’s Deception Policy Statement. They are also used by the CFPB, DC Consumer Protection Procedures Act, and Maryland Consumer Protection Act. They apply to hidden fees, misleading loan terms, and buried fine-print traps.

But not every shady tactic qualifies. Whether conduct crosses the line depends on the facts: what was said or omitted and how it harmed you. If something feels off, we’ll dig in and find out if the law sees it that way too.

Several laws give homeowners real power:

- RESPA § 2605 & Regulation X – This federal law allows you to ask for a complete account history. You can dispute wrong payments and sue for damages if the servicer keeps making mistakes.

- Truth in Lending Act (TILA) & Regulation Z – These require accurate loan statements and timely notices of interest-rate or escrow changes.

- DC Home Loan Protection Act (D.C. Code § 26-1153) –This law prevents servicers from using predatory lending practices and unfair loan terms in the District.

- Maryland Consumer Protection Act (Md. Com. Law § 13-301) – Makes “unfair or deceptive” servicing practices actionable in state court.

Which law applies (and how strong the claim is) depends on the paperwork, timelines, and harm you’ve suffered. Bring us your statements and correspondence, and we’ll pin down the best path forward.

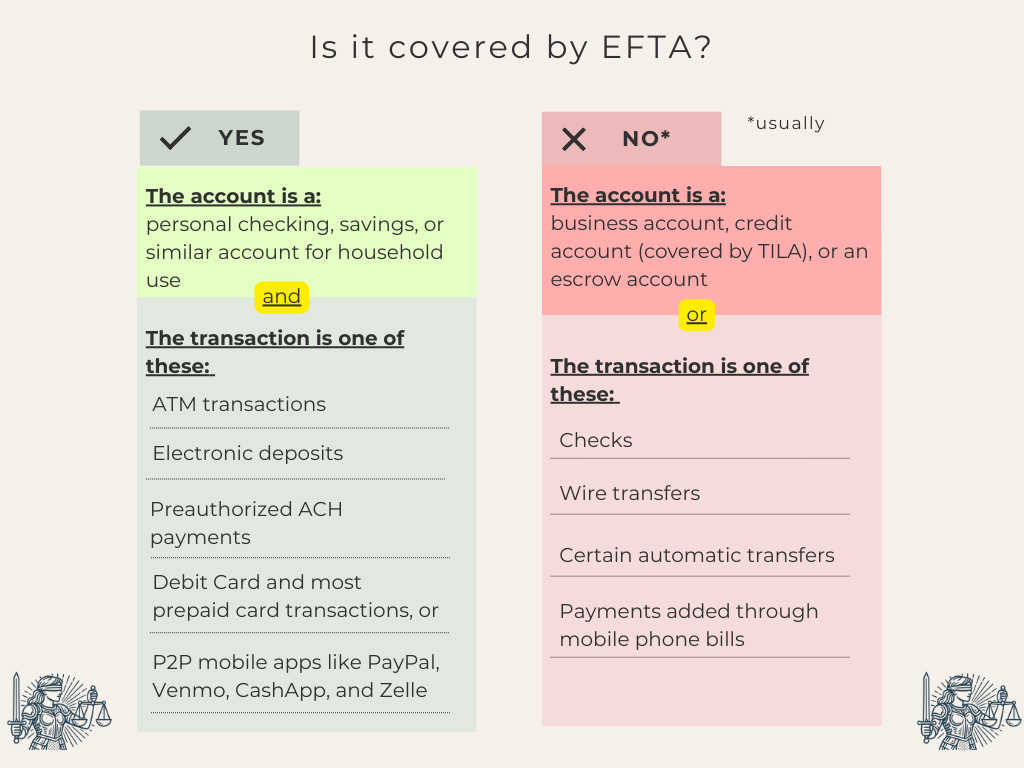

Yes. Federal laws, the Electronic Fund Transfer Act (EFTA) and Regulation E, requires your bank to:

- Investigate errors.

- Provisional credit your funds.

- Correct the mistake.

You must report the error within 60 days of seeing it on your statement.

If the bank delays or denies a valid claim, EFTA allows you to sue. You can claim actual losses, up to $1,000 in statutory damages for each violation, plus your attorneys’ fees.

Many state consumer-protection statutes add more leverage, like those in Maryland. The key is speed and documentation. Save the disputed statement, your written dispute, and any bank responses.

During the consultation, we can start discussing how strong your claim could be.

It often can, if you act fast.

In Washington, DC, we can file a complaint in Superior Court. We may request a temporary restraining order (TRO) or a preliminary injunction. This would pause the sale while we address the servicing-error claims.

In Maryland, we can (1) move to stay the sale under Md. Rule 14-211, (2) record a lis pendens so buyers see the title is contested, and (3) seek an injunction in Circuit Court. Courts give these remedies if you prove credible servicing violations and act before the auction date.

The sooner you get help, the more tools you have to keep you in your home.