Bank Fraud, Zelle Scams, Bank Disputes, & Refunds

Lost money to a bogus charge or even after a bank account takeover?

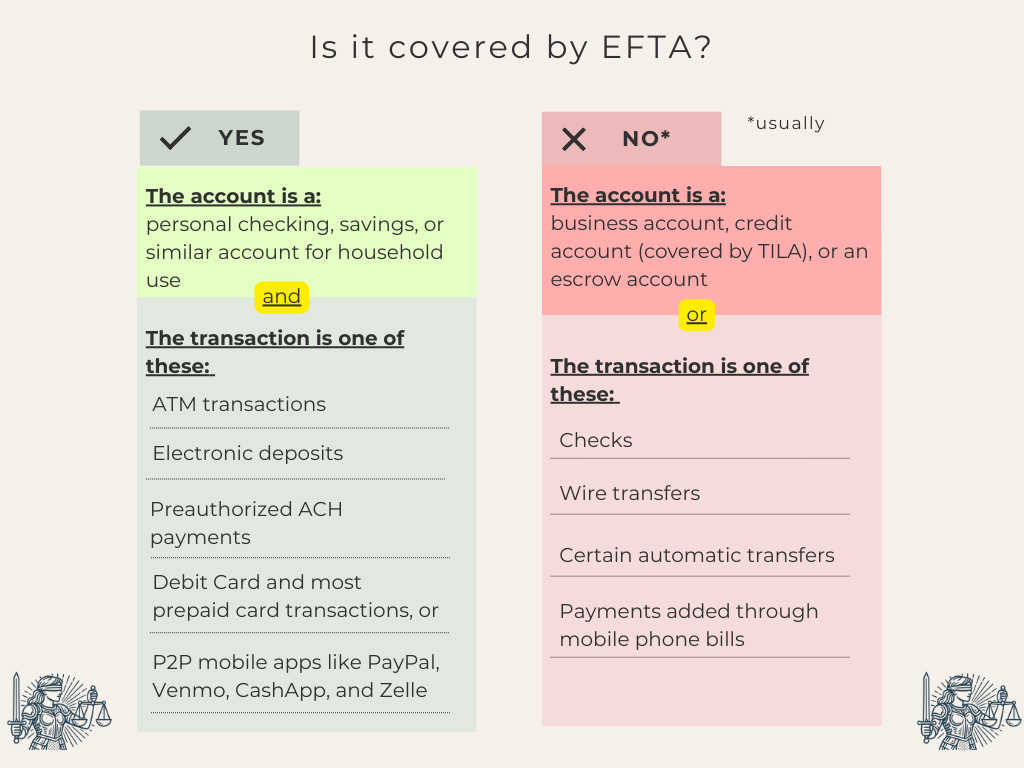

Get a bank fraud lawyer to make banks investigate the charge. They can help you get a full refund using EFTA, TILA, and state consumer protection laws.

Contact us for a free consultation. A chargeback lawyer can help you get back the money that’s rightfully yours.

If you didn’t consent to the charge and you told your bank, they must fix it.

Your money vanished. Maybe it was a scammer who took over your account or a charge you didn’t agree to. You reported it fast. And what did the bank do? Nothing, or worse, they blamed you.

Meanwhile, your account balance drops, you get hit with overdraft fees, and bills bounce. Banks count on you giving up. But the law is on your side, if you know how to use it.

Under federal law, banks can’t just ignore your claim. They can’t bury it in red tape, and they can’t drag their feet, hoping you’ll give up. If a transaction was not authorized, the law is clear: the bank must investigate it fairly. And often, they have to credit your account while they do.

Common Violations

- Fraudulent or unauthorized charges you didn’t make

- Charging for goods or services never received

- Delayed or denied provisional credit while they “investigate”

- Not stopping interest or late fees during a dispute

- Investigations that are rushed or nonexistent

- Closing the dispute without giving you a written explanation

- Fees and overdrafts that pile up while your account is drained

What the law requires

Debit Cards:

- Investigate within 10 business days

- Provide provisional credit if it takes longer

- Issue written findings with supporting evidence, if requested

- Remove any fees caused by the disputed charge

Credit Cards:

- Acknowledge disputes within 30 days

- Resolve them within 90 days

- Stop the collection of the disputed amount

- Fix the account if the charge was improper: including interest and fees

We help clients enforce their rights

We’ve seen how banks cut corners. How they rubber-stamp denials. How they “close the case” without lifting a finger. But the law gives you tools, if you know how to use them

Don’t let them drain your account or bury you in excuses. We help you fight back.

Related articles from The Dispatch

The Dispatch is where we break down legal issues, explain your rights, and share real stories from the front lines. Think of it as our way of keeping you informed and ready to fight back.

-

4 Ways Zelle Let Fraud Flourish (and Why New York Is Now Suing)

Zelle markets itself as “fast, safe, and easy.” Fast? Yes. Safe? Not exactly. New York Attorney General Letitia James just sued Zelle’s operator, Early Warning Services (EWS), for turning a peer-to-peer payment shortcut into a fraud-free-for-all. If that sounds familiar,…

-

Bitcoin ATM Scams: Why Smart People Lose Money (And How to Fight Back)

I: The Blame Game If you lost money through a Bitcoin ATM scam, you have probably replayed that moment in your head a thousand times. You might be thinking, When I investigated scams at the FTC and the CFPB, I…

-

5 Things That Could Be Covered By Consumer Protection Laws

Consumer protection issues can be less obvious than problems in divorce or criminal law. This is especially true today, where it feels like almost every business has hidden fees or mystery charges. But consumer protection laws exist so that you…