Chargeback & Billing Disputes Help

Wrong charge on your statement? Double billing?

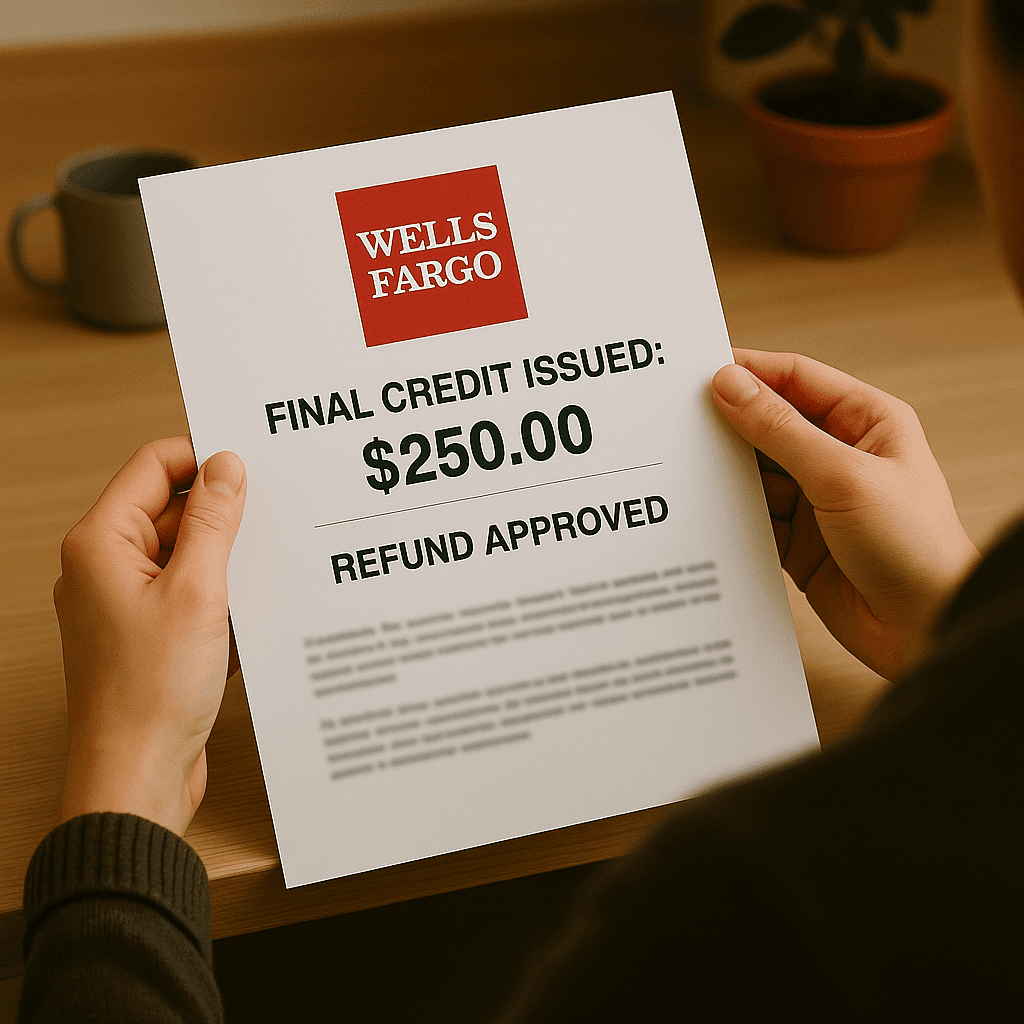

Get help from a chargeback lawyer to force banks to refund every cent, plus fees by using EFTA & TILA .

Contact us to start your case

Common Problems

And then your bank made it worse:

Potential Solutions

You were charged without consent. That’s Illegal.

You fought the charge.

And you were right.

You knew the company, but you didn’t approve the charge.

It wasn’t some scam site. Maybe it was a store or service you’ve used before and even trusted.

But now your account shows a charge you never agreed to. Or a delivery that never came.

When you asked about it, the company passed the blame. Or your bank said it was “authorized,” just because you’ve shopped there

before.

You’re not being difficult. You’re not asking for a favor. You’re asking for what’s fair.

When the merchant gets it wrong—and the bank lets it slide

Some companies make billing mistakes. Others make a habit of it. They tack on fees. Ship nothing. Charge for services that were never provided.

That’s bad enough. The main issue arises when the bank won’t reverse the charge or fails to investigate properly.

You send evidence. They ignore it. You follow up. They say you “missed a deadline.” You ask for updates. They close the case, without refunding anything.

Under federal law, they can’t do that. If they do, we hold them accountable.

What we do about it

By the time clients come to us, they’ve already tried the right way.

They filed a dispute. They sent the receipts. They waited.

And the bank told them: case closed. No refund. Nothing more we can do.

That’s where we come in.

We don’t help banks investigate. We sue them when they don’t.

Banks break the law when they don’t investigate, miss deadlines, ignore proof, and denied claims without reason. If they break the law, they could owe you statutory damages, actual losses, and attorneys’ fees.