Scam Charges, Bank Fraud, & Zelle Account Takeovers

A fraudster drained your account, then the bank blamed you.

Our bank fraud lawyers use EFTA & TILA to secure refunds and damages.

Contact us for help.

Common Problems

Potential Solutions

You Didn’t Miss It.

They Just Didn’t Fix It.

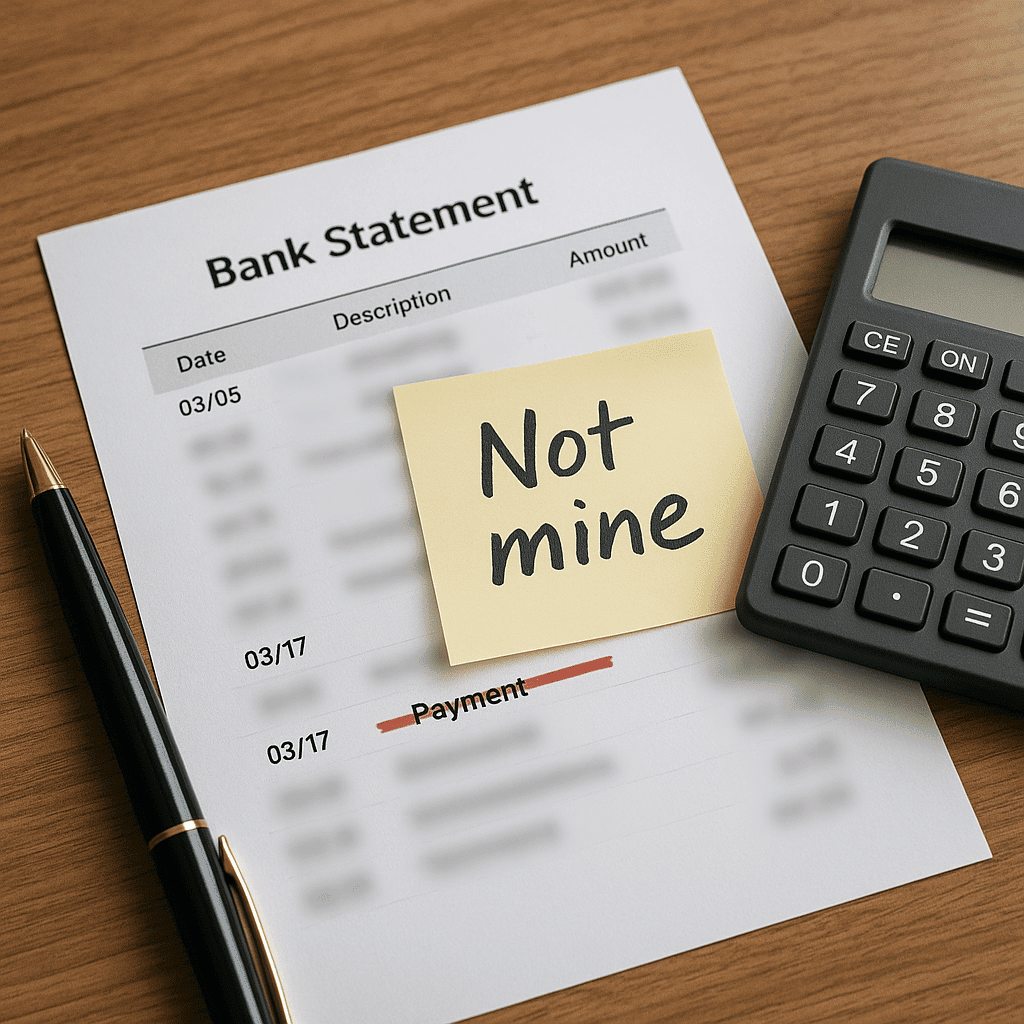

You didn’t make that charge. Now they’re saying you did.

It’s right there on your bank statement — a company you’ve never heard of, charging your account. You didn’t buy anything. You didn’t sign up for anything. But the money’s gone.

And when you called the bank? They said it wasn’t fraud. Or that you authorized it. They said there was nothing they could do. Maybe they even closed your account.

You’re not crazy. You’re not alone. And you’re not stuck.

How scam charges happen

Fraudsters take money from people by using stolen card numbers, fake business names, or small test charges. They can take hundreds of thousands of dollars.

Some hide behind fake websites. Some get your info from data breaches. Some pose as lenders or subscription services and hope you don’t notice.

But the real problem starts when the bank doesn’t fix it.

Under federal law, they have to investigate. They may have to credit your account while they do. And they have to do it fast.

When they don’t, you have the right to fight back.

What we do about it

We don’t chase the scammer. We go after the bank that let it happen and refused to fix it.

Federal law says banks must quickly look into fraud. They should credit your account while they investigate. If the charge is unauthorized, they must resolve it in your favor.

We hold them accountable. If they violate your rights, we sue. And we don’t back down just because the bank says it “followed policy.”

Their policy doesn’t override your legal rights.